What Are the Benefits of an Irrevocable Trust?

When we discuss trusts in the context of estate planning, we often focus on revocable trusts. While revocable trusts have many uses and benefits, including the fact that they can be dissolved and modified, there are certain situations in which an irrevocable trust may be more beneficial. In this blog, we will discuss the unique benefits of an irrevocable trust and explain situations in which an irrevocable trust may be the best option for meeting your needs.

When we discuss trusts in the context of estate planning, we often focus on revocable trusts. While revocable trusts have many uses and benefits, including the fact that they can be dissolved and modified, there are certain situations in which an irrevocable trust may be more beneficial. In this blog, we will discuss the unique benefits of an irrevocable trust and explain situations in which an irrevocable trust may be the best option for meeting your needs.

Irrevocable Trust Advantages and Disadvantages

An irrevocable trust is a powerful estate planning tool that offers numerous benefits. Many people use an irrevocable trust to protect assets from creditors or lawsuits. With an irrevocable trust, the assets placed into it are no longer owned by the grantor, so they cannot be seized under most circumstances. For example, a doctor or surgeon may use an irrevocable trust to protect their assets from future malpractice claims.

A special needs trust is a special type of irrevocable trust that is often used in estate planning for people with disabilities. A special needs trust can provide financial support to a disabled person without jeopardizing their eligibility for government benefits. The trust is designed to supplement government assistance programs like Medicaid and Supplemental Security Income (SSI).

Another reason some people use irrevocable trusts is to reduce estate taxes. When assets are transferred to an irrevocable trust, they are no longer part of the grantor’s estate and are, therefore, not subject to estate taxes. This can be especially beneficial for very wealthy individuals who want to pass on more of their assets to their heirs.

Is an Irrevocable Trust the Right Choice for Me?

There are certainly benefits associated with an irrevocable trust. However, there are also limitations. Irrevocable trusts cannot be modified or dissolved, so you must be certain that the terms of your trust are in line with your wishes and goals before signing it. You should also keep in mind that an irrevocable trust can be costly to set up and maintain.

Whether or not an irrevocable trust is the right choice for you will depend on your financial situation, estate planning goals, and the type of assets you wish to protect. You should speak with an experienced attorney to discuss your options and determine if an irrevocable trust is the best option for you.

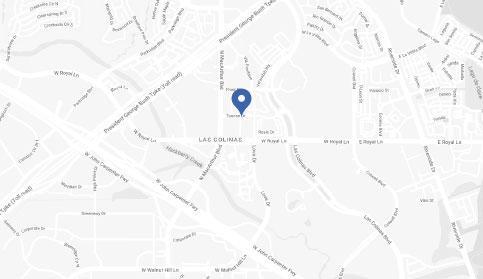

Contact our Irving Estate Planning Lawyer

At Andrew Dunlap Attorneys, PLLC, experienced Irving estate planning lawyer Andrew A. Dunlap can help you explore all of your estate planning options and determine the best strategy for your unique needs. Call 972-807-6357 for a confidential case assessment to get started.

Source:

https://www.kiplinger.com/retirement/estate-planning/601127/the-only-3-reasons-you-should-have-an-irrevocable-trust

972-807-6357

972-807-6357